Millions of people use Capital One banking apps, cards, and services every day. People trust the bank to give stable access to their money. When a large outage hit, many users could not log in. Some users could not pay bills or make purchases. These customers faced big problems and lost time and money.

This outage was not a small glitch. It shut down key systems for hours. People across the United States felt the impact. Some could not access accounts. Others lost work pay or missed important payments. This event sparked concern about legal rights and losses.

Some users and law firms looked at the outage as a legal issue. They asked if Capital One failed to protect users. They asked if harm from the outage should have a legal remedy. This question led to talk about a class action lawsuit. People want facts, eligibility help, and clear steps to act.

This article covers what happened, what a class action is, who can join, what claims may apply, and how the case moves in court. The goal is to help readers understand their rights and options. This guide uses simple words any reader can grasp.

What Happened During the Capital One Outage

Capital One suffered a major tech outage that left users locked out of their accounts. Online banking, mobile apps, ATMs, and card services all stopped working without warning. People couldn’t send money pay bills or use their cards at stores.

The issue struck during peak hours and caused widespread frustration. Many users faced late fees, declined transactions, and missed payments. Capital One confirmed the problem and said engineers worked fast to restore service. Though systems were fixed within hours the damage had already left many users stressed and angry.

News outlets covered the story as users shared their experiences online. Some reported lost income or embarrassment during failed transactions. The incident sparked legal questions about who should take the blame when a bank’s system breaks down.

What Is a Class Action Lawsuit?

A class action lawsuit is a legal case where many people come together over the same issue. One or more individuals represent the full group, known as the class. Everyone in that group shares a similar harm or loss caused by the same party.

These lawsuits help when it’s hard for one person to fight alone. Grouping claims makes it easier to cover legal costs and gather strong evidence. It also puts pressure on large companies that may not respond to single complaints.

Before a class action can move forward, a court must approve it. The court checks that the claims are alike and tied to the same defendant. Once approved, the case becomes one legal action for the entire group.

In the end, class members may receive money or other forms of relief. The court oversees the process to make sure it’s fair for everyone involved.

Why Capital One Customers Are Talking About a Lawsuit

When access to money is suddenly blocked, real harm can follow. People miss bill payments, pay late fees, or lose business. Some face stress, delays, or lost trust. These problems raise real legal questions.

Many users feel Capital One failed to protect its systems. They want answers-and in some cases, compensation. Some believe the bank should be held responsible for what they went through.

Law firms track events like this. If many people face the same type of loss, a class action may follow. That happens only if the legal standards for shared harm are met.

As media coverage grew, more users began asking if a lawsuit was possible. Some wanted to join one. Others asked if they should speak to a lawyer. This guide explains the legal options and what affected users can do next.

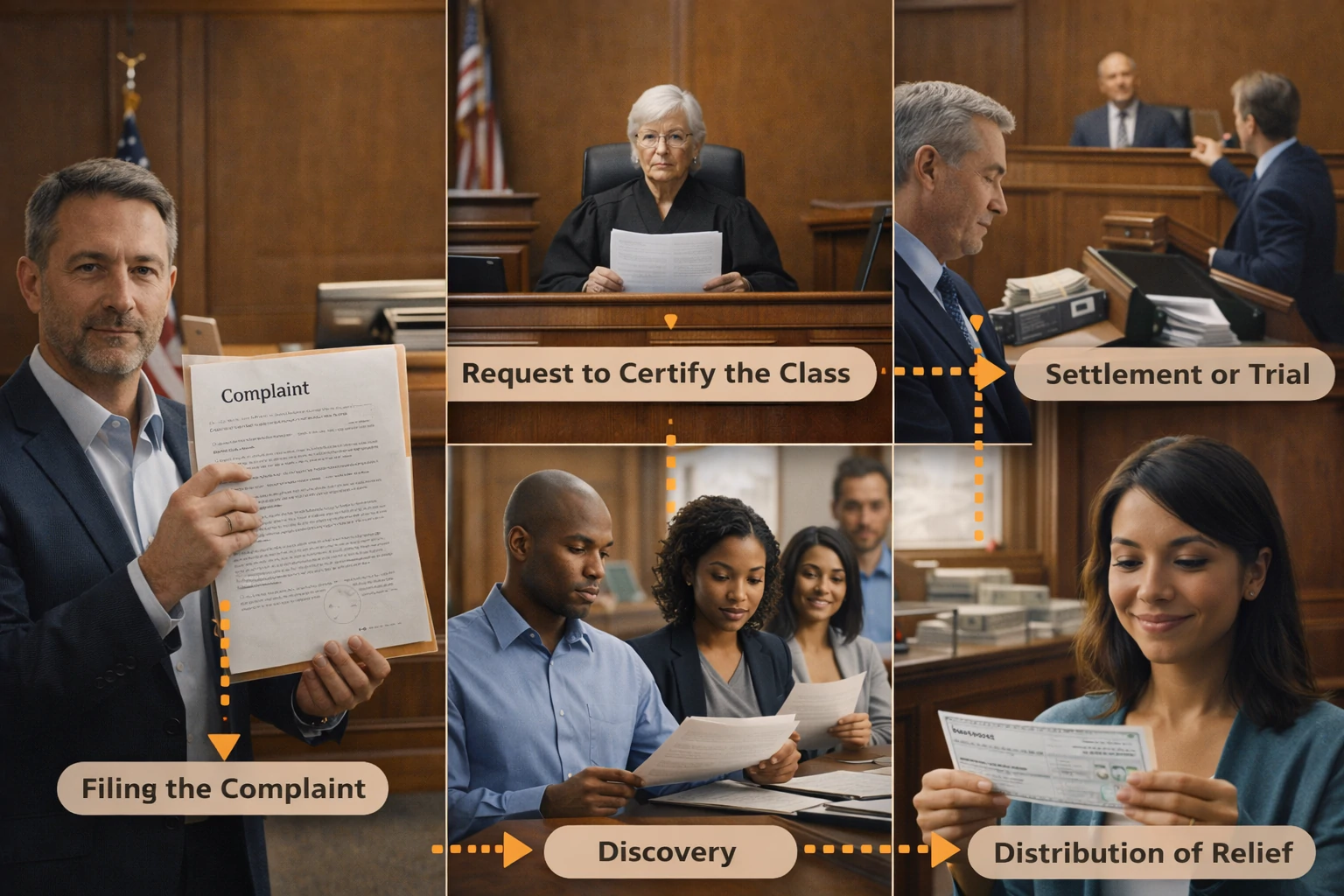

How a Class Action Works Step by Step

A class action moves through the legal system in clear stages. Each step follows set rules to protect the rights of everyone involved.

Filing the Complaint

The process begins when lawyers file a complaint. This document explains the harm done and why the bank-like Capital One-is legally responsible. It also asks the court to approve a group (the class) of people affected in the same way.

Request to Certify the Class

Next, the lawyers request class certification. The judge checks if the group is large enough and if the claims are similar. If the court agrees, the case becomes an official class action.

Discovery

Once certified, both sides begin discovery. They collect and share documents, facts, and witness statements. This builds each side’s case with clear proof of harm, technical issues, and company actions.

Settlement or Trial

Most class actions end in settlement. The company may agree to pay or take action to fix the harm. The court must approve the deal to ensure fairness. If no deal happens, the case goes to trial, where a judge or jury decides the outcome.

Distribution of Relief

If the class wins or reaches a deal, members may receive payments or other relief. The court oversees the process to make sure everything is fair and that those affected can claim what they’re owed.

Legal Grounds That Could Support a Capital One Outage Lawsuit

If a class action moves forward, it must rest on strong legal reasons. These are the common claims lawyers may use to argue Capital One is responsible for the outage:

Breach of Contract

Banks enter agreements with their customers. These often promise reliable service and access to funds. If Capital One failed to meet those promises, users may claim breach of contract. Lawyers often review account terms for service guarantees.

Negligence

Negligence means a company failed to act with proper care. If Capital One didn’t manage its systems responsibly, users may argue the bank was careless. To succeed, lawyers must show the bank owed a duty, failed that duty, and caused harm.

Unjust Enrichment

This claim argues a company made money unfairly. For example, if Capital One charged fees during the outage, users may say the bank kept money it didn’t earn. That could support an unjust enrichment claim.

State Consumer Protection Laws

Many states have laws that protect users from unfair or deceptive practices. If the outage caused financial harm or misled customers, some state laws may apply. These vary depending on where the user lives.

Other Legal Theories

Every case is different. Some lawsuits use more than one claim. Legal teams study the facts and choose the strongest grounds for action.

Who Might Qualify to Join the Capital One Outage Lawsuit

Not everyone affected by the outage will qualify. Courts and lawyers define who is eligible based on facts and legal standards.

You may qualify if you:

- Had an active Capital One account during the outage period

- Suffered a financial loss or service disruption tied directly to the outage

- Live in a state where specific consumer protection laws may apply

A sample class definition might read:

All U.S. Capital One customers who held active accounts between [DATE] and [DATE] and experienced losses due to the system outage.

You may be excluded if:

- You did not suffer any loss

- You already accepted a refund or settled a related claim

If your situation matches the class terms, you may be eligible to join and receive compensation if the case succeeds.

Examples of Loss That May Qualify

Not all harm counts as legal loss. Harm must be measurable and tied to the outage. Examples could include:

- Bank fees due to failed payments.

- Business losses tied to payment failures.

- Lost wages due to inability to access funds.

- Costs to fix errors caused by the outage.

Each claim must show evidence. A bank statement, fee notice, or proof of loss helps. Lawyers review facts to decide if harm is valid.

Claims Process: How to Join a Lawsuit

If the court approves a class action, it sends official notices to those affected. These notices may come by email or mail. They explain how to take part, how to opt out, and what deadlines apply.

Your first step is to read the notice carefully. It outlines your rights and shows what to do next. If you want to stay in the case just follow the steps. you’d rather sue on your own you can opt out-but only before the deadline.

If the notice asks for a claim form fill out and submit it on time. This form may ask for account details how you were affected and proof of loss. You might need to include documents like fee records or bank statements.

Every part of the process has deadlines. Missing one could block you from getting any payment. To stay protected, follow all steps early and keep copies of what you send.

⚖️ Legal Tip:

If you faced a failed payment, extra fee, or missed deposit during the Capital One outage, you may qualify for a class action claim. Save your proof. Your documents could be your ticket to compensation.

What Kind of Compensation You Could Receive

Compensation depends on your loss and what the court approves. Some users may get money. Others may receive credits or future service improvements.

Direct Payments

If you lost money during the outage, you may get paid back. This includes late fees, failed transfers, or missed payments.

Fee Credits

You might receive account credits instead of cash. These credits can reduce future charges or correct past errors.

Policy Changes

The court may also require Capital One to improve its systems. This helps prevent future outages and protects customers going forward.

No Guarantee of Money

Not every case ends with payment. If claims are weak or proof is missing, users may get nothing. Timing and evidence matter.

Many users affected by digital platform failures are now joining legal actions. One example is the ongoing MyChart Class Action Lawsuit 2026 over access and data concerns. It shows how tech-linked outages may trigger strong legal claims.

How Much Time You Have to Act

Every class action runs on a strict legal clock. As soon as the court approves the case, deadlines follow quickly. You won’t have forever to decide. Timing is everything.

Once approved, the court sends notices to affected users. These may come by email or traditional mail. They explain how to file a claim, how to opt out, and exactly when to act. You must read that notice carefully. Missing a step could lock you out.

Some people think the notice isn’t urgent and delay their response. That’s a mistake. If you miss the deadline, you lose your spot in the case. You may not receive compensation. You won’t have another chance to join later.

In most class actions, deadlines last a few weeks to a few months. That’s not much time if you need to gather proof or ask legal questions. The sooner you act, the better your chance to protect your rights and receive what you’re owed.

⏳ Deadline Alert:

Claim forms are usually accepted for a short time once the court approves the case. Don’t wait. If approved, the window to submit may close within weeks.

Other Legal Options Beyond a Class Action

A class action helps many people at once, but it does not fit every case. If your loss feels different or you want full control, you may file your own lawsuit. This path works best when your harm is clear and the amount is high. You may need a private lawyer to help with the process.

Some users choose small claims court. This is a faster and cheaper way to seek justice. You do not need a lawyer in most cases. If your loss falls under the limit set by your state, this option may work well. You must still bring proof and explain your side.

Another choice is to file a complaint with a state or federal agency. Groups like the Consumer Financial Protection Bureau review cases like this. They collect reports and may launch action against the bank. This can lead to rule changes or penalties.

You may not know which step fits your case. That’s why speaking with a lawyer helps. Many offer free calls or reviews. They can guide you without pressure. Time matters in legal cases, so act early to protect your rights.

Recent Updates on the Capital One Outage Case

The legal process continues to move forward. Courts may adjust deadlines, respond to motions, or change the scope of the lawsuit. Lawyers on both sides may also revise class definitions or add new claims as more facts come in.

Discussions about a possible settlement may begin at any time. These updates often depend on the court’s schedule and the pace of discovery.

If you are part of the class or think you may qualify, it is important to stay alert. Watch for updates from official court records or legal notices. These notices may arrive by email or regular mail.

They often include deadlines and steps for filing claims or opting out. Keep every document you receive. It may help you later if questions arise or if you need to prove your right to compensation.

Tips for Affected Capital One Customers

| Tip | Details |

|---|---|

| Keep Records | Save bank statements, fee notices, and payment logs. These help prove loss. |

| Read Official Notices | Take time to read court notices and emails. They tell what you must do next. |

| Check Deadlines | Set reminders for claims and opt-out dates. Do not miss court deadlines. |

| Ask for Help | If you do not understand, talk to a lawyer. Some attorneys offer free case reviews. |

Why This Case Matters

This lawsuit reflects more than a tech glitch. People rely on banks daily-to pay bills, send money, and cover basic needs. When access fails, the damage is immediate. Missed rent, business losses, and stress all follow.

The Capital One outage showed how deeply a system failure can affect lives. It raised legal questions too-should banks be held responsible when users can’t reach their money?

If errors led to real harm, the court may demand answers. A win could lead to better systems, faster alerts, and stronger protections. That’s why this case matters-not just for users today, but for the future of digital banking.

Conclusion

The Capital One outage class action lawsuit is a major legal issue for many customers. It involves rights, losses, and legal steps. This guide explains the facts, claims, eligibility, and process. It breaks down the law in simple terms.

If you lost money or access due to the outage, you may qualify to join. Make sure to read notices and act before deadlines. Save evidence and seek help if you feel unsure.

This legal issue shows how important reliable service is in modern life. It also shows that consumers have tools to seek compensation and fairness. Stay informed as the case moves forward. Your rights matter, and careful action now may make a difference later.

Lawsuits involving companies like Material Inox show how corporate actions can trigger major legal consequences when public trust breaks down.