Kraft Heinz is a well-known food company in the United States. Its products fill shelves in homes, schools, and stores. From ketchup to boxed dinners, many families trust this brand. But a legal battle has raised new questions. A major class action lawsuit changed how investors and the public view the company.

This case is not just about one small mistake. It involves years of financial reporting. The lawsuit claims that Kraft Heinz misled investors about the true health of its business. The results were sharp losses in stock value. This guide explains what happened, who qualifies for a payout, and how to file a claim. You will also learn about deadlines, the Fair Fund, and what this case means for your rights.

The class action lawsuit led to a large settlement. The court approved hundreds of millions of dollars in relief. If you owned shares of Kraft Heinz during certain dates, you might be eligible. Filing a claim on time could lead to compensation. This article gives you the full story in plain terms.

What Led to the Kraft Heinz Class Action Lawsuit

The case started with a financial shock. In early 2019, Kraft Heinz reported a $15 billion write-down of two major brands. It also cut its dividend. The company revealed that the U.S. Securities and Exchange Commission (SEC) had begun an investigation. On that day, the stock price dropped more than 25 percent.

Shareholders were stunned. Many had believed the company was growing. But the report exposed problems with its accounting. Investors lost confidence. The SEC later found that Kraft Heinz had inflated cost-saving figures. These numbers were part of public reports. The mistake misled the market.

Soon after the drop, multiple investors filed lawsuits. The court combined these into one class action. The complaint claimed that Kraft Heinz and its leaders broke federal securities laws. They did not give honest numbers to the public. As a result, people who bought shares lost money when the truth came out.

What the Lawsuit Covers

This lawsuit focuses on investors. It does not cover product complaints. If you bought Kraft Heinz stock during the class period, and lost money, you may be part of the case. The class period usually refers to February 2016 through February 2019.

The lawsuit includes claims against top executives. It also mentions Kraft Heinz’s accounting firm. The main charge is that they knew, or should have known, the data was false. They kept telling the public that the company was doing well. In reality, internal issues hurt its value.

The lawsuit went to the U.S. District Court in Illinois. It took several years to move through legal steps. In 2023, the court approved a large settlement. This created a path for investors to claim back some of their losses.

Kraft Heinz Fair Fund

The Kraft Heinz Fair Fund is part of the final settlement. The SEC created it to collect fines and return money to harmed investors. This fund is separate from the class action lawsuit. But both aim to give relief to the same people.

In 2021, Kraft Heinz agreed to pay $62 million to the SEC. The company did not admit wrongdoing, but it accepted the penalty. The SEC placed the money in the Fair Fund. The goal is to repay investors who lost money due to fraud.

The fund works with a claims administrator. You must file a claim to receive payment. The process includes proof of stock purchases, dates, and losses. All claims must meet deadlines. If you qualify, you will get a share of the fund based on how much you lost.

Timeline of Key Events

Understanding the case means following the timeline. Here are major dates that shaped the lawsuit:

- February 2019: Kraft Heinz announces a large write-down and SEC probe. Stock drops 25 percent.

- March 2019: Investors file the first lawsuits.

- September 2021: Kraft Heinz settles with the SEC.

- Early 2023: Court approves a $450 million class action settlement.

- Mid 2023: Fair Fund begins claims process.

- 2024: Claims reviewed and payments expected to begin.

Each stage opened new parts of the case. Investors who acted early had more time to file. The settlement and the Fair Fund are now in the final phases. Payouts are being prepared.

Kraft Heinz Settlement Payout Per Person

Many people want to know how much they will get. The payout per person depends on several things. There is no fixed amount for everyone. Instead, it is based on:

Number of shares you bought

The more shares you held during the class period, the higher your potential payout. Every share counts toward your total loss calculation.Purchase and sale dates

Timing matters. If you bought shares during the class period and held them when the bad news broke, you are more likely to qualify. Selling too early may reduce or remove eligibility.Loss amount based on court formulas

The court uses a set formula to measure your loss. This compares your purchase price with the adjusted price after the fraud was revealed.Total number of approved claims

The final payout also depends on how many investors filed valid claims. The fund is divided among all approved claims, so a larger pool means smaller individual payments.

The total fund includes $450 million. This money is divided among all approved claims. Some people may receive a few hundred dollars. Others could get thousands. It depends on the size of their loss and how many people filed claims.

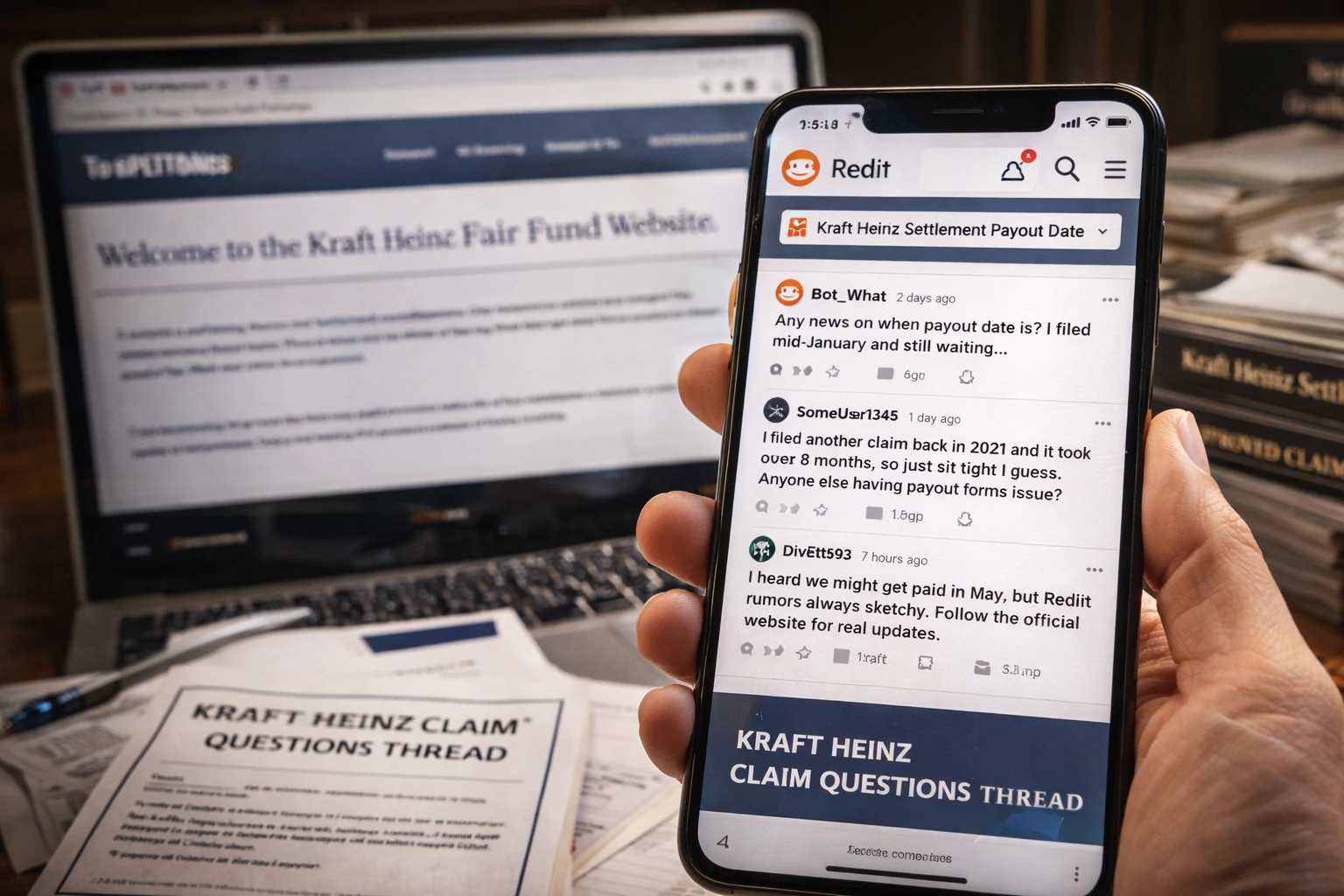

Online forums like Reddit show different payout guesses. Some users expect a few cents per share. Others hope for more. But only the claims administrator can give the real answer. Wait for your claim review and notice of payment amount.

Kraft Heinz Settlement Payout Date

The settlement payout date is a top concern. Many investors ask when the money will come. As of now, reviews are still underway. The court approved the final deal in 2023. Claims started soon after.

Payments usually begin six to twelve months after final approval. That means many users may get money in late 2024 or early 2025. The claims team must check all forms before releasing payments.

Delays can happen. If there are too many claims or missing data, the process may slow down. Always check your email or the settlement website for updates. If your bank or mailing address changes, notify the team right away.

Kraft Heinz Settlement Payout Date Reddit Discussions

If you want to receive money from the Kraft Heinz class action lawsuit, you must formally file a claim. Simply owning shares during the class period does not guarantee payment. You must take the right steps to be considered.

The official settlement website clearly lists the claim deadline. If you miss it, you may lose your right to any compensation. Follow these steps to file your claim correctly:

Visit the official Kraft Heinz Fair Fund or class action settlement website

Only use trusted sites-typically ending in “.gov” or listed in court documents. Avoid unofficial pages that ask for login details or payments.

Carefully read all instructions and deadlines

Take your time. The form includes important rules, document requirements, and whether to file online or by mail.

Gather your trade records and account details

You’ll need proof that you bought Kraft Heinz stock during the class period. This includes purchase dates, prices, and the number of shares usually found in brokerage statements.

Fill out the claim form completely and accurately

Use the online form if possible. It’s faster and easier to track. If you choose to file by mail, make sure your handwriting is clear.

Review everything before submitting

Double-check your information. Make sure every required field is filled, your documents are attached, and your signature is included.

Submit your form before the deadline

Courts rarely accept late claims. Submitting early gives you more time to fix issues if any come up.

Real Feedback: Still Waiting on Payment

I sent my claim form in September 2023. Got the confirmation in October. Still no payout as of January 2026, but they say the review is still ongoing. I check the official site every few weeks.

– Daniel S., Tampa, Florida

Common Mistakes

| Mistake | Why This Step Matters |

|---|---|

| Missing trade documents | No proof = no payout. Attach full broker statements. |

| Incomplete claim forms | Skipped fields pause or cancel reviews. |

| Missing signature or blanks | Unsigned forms are rejected. |

| Wrong mailing or bank info | Payment can fail or get lost. |

| Late submission | Missed deadline = ineligible for payment. |

Kraft Class Action Lawsuit Sign-Up Process

If you want to receive money from the Kraft Heinz class action lawsuit, you must formally file a claim. Simply owning shares during the class period is not enough-you must take action.

The official website will list the deadline clearly. Missing it could mean losing your chance to get paid. Here’s how to sign up the right way:

File Your Claim

Visit the official Kraft Heinz Fair Fund or class action settlement website

These are the only trusted sources. The correct URLs are usually listed in court notices or SEC pages.

Carefully read all instructions and key dates

Make sure you understand the deadline, required documents, and submission options (online or mail).

Gather your trade records and account details

You’ll need clear proof of stock purchases, including dates, prices, and the number of shares.

Fill out the claim form completely and accurately

Use the online form for faster processing, or print the paper form if you prefer to mail it.

Review everything before submitting

Double-check your entries, attach all documents, and make sure your signature is included.

Submit before the deadline

Late claims are usually rejected unless the court allows exceptions-which is rare.

Once submitted, you should receive a confirmation email or letter. Keep that for your records. If anything is missing or unclear, the claims team may contact you.

If you have questions or run into problems, reach out to the administrator directly. You do not need a lawyer to file. The process is free, and the official team is there to help.

User Story: Claim Filed Successfully

I submitted my claim through the Fair Fund site with my broker statement from 2018. They accepted my documents and sent a confirmation email in about two weeks. I didn’t need legal help. Just followed the instructions and it worked.

-Michelle T., Columbus, Ohio

What Happens After You Submit the Claim Form

Once you submit your claim form, the review process officially begins. A third-party administrator takes over from there. Their job is to review each form, check for errors, and verify all documents you submitted. This includes cross-checking your trade records with official market data to make sure the losses match the case terms.

This review stage can take several weeks or even months, depending on how many people filed and how complete the forms are. If there’s a problem-like missing documents or mismatched dates-you may get an email or letter asking for more information. That’s why it’s important to watch your inbox and respond quickly if asked.

If your claim is complete and valid, it moves to the approval stage. Once approved, you’ll be added to the payment queue.

Payout Schedule After Approval

After your claim is approved, the administrator prepares your payment. Some investors receive direct deposits, while others are sent paper checks in the mail. The delivery method depends on what you selected during the claim process.

The timing can vary. If many claims are ahead of yours, you may wait longer. Payment batches often go out in phases. You’ll get a notification once your payment is on the way.

Remember, if your bank info or address has changed, contact the administrator immediately. Wrong details can delay or block your payout-even after approval.

Who Qualifies for the Kraft Heinz Lawsuit Payout

You may qualify for a payout if you purchased Kraft Heinz stock between February 2016 and February 2019 and suffered financial losses. This time frame is called the class period. To be eligible, you must have still held your shares when the damaging news came out in February 2019, which triggered the stock price drop.

If you sold your shares before the announcement, you likely avoided the loss and may not qualify. Only those who were directly affected by the sudden drop in stock value can be considered for payment. The court and claims administrator use your purchase and sale history to calculate this.

Importantly, you do not have to be a U.S. citizen to take part. Many class actions accept claims from international investors, as long as they bought shares on a qualifying U.S. exchange. However, always check the official case notice or website to confirm your eligibility based on your country and account type.

If you’re unsure, gather your trade records and contact the claims administrator. They can help confirm whether your stock activity meets the requirements.

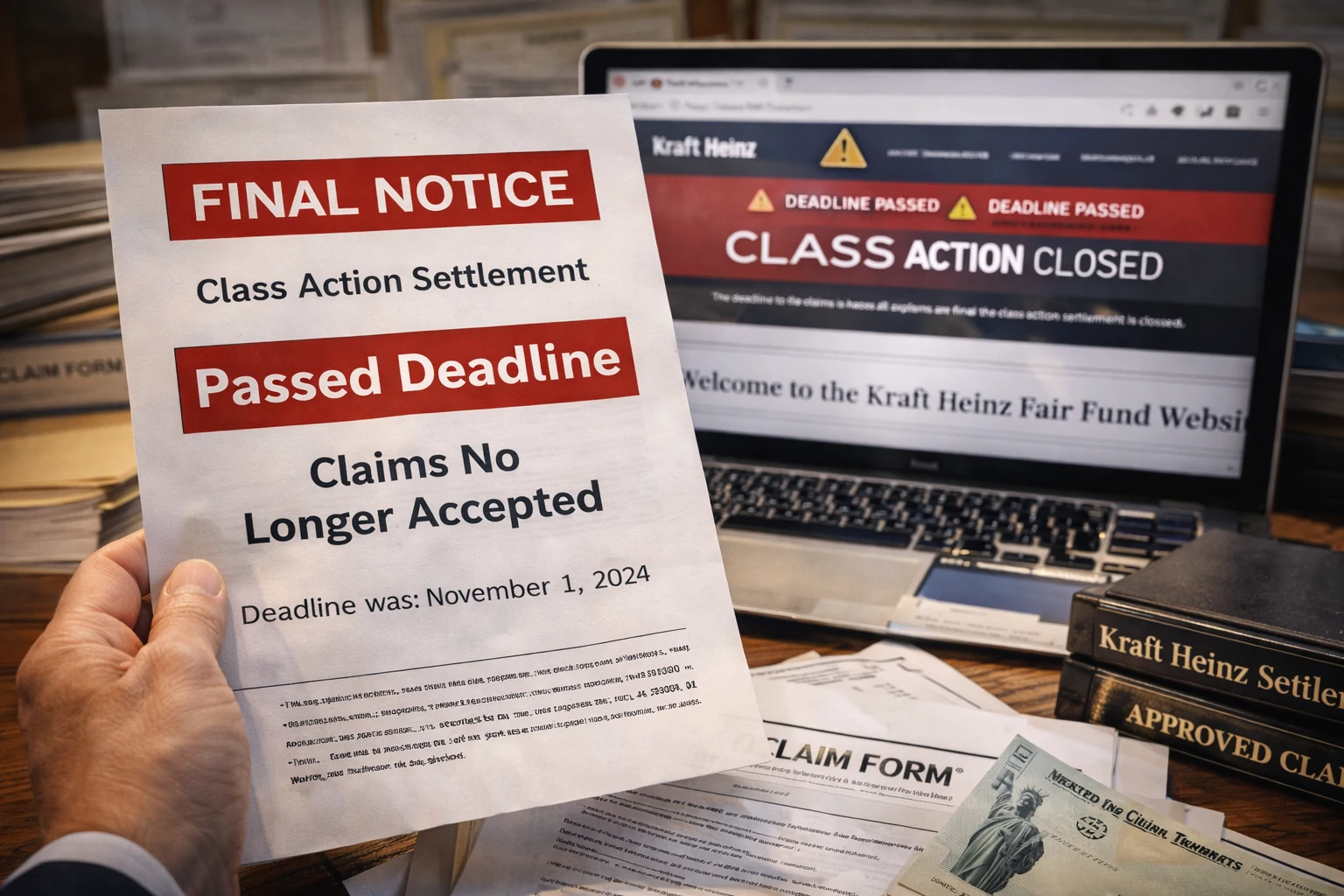

Can You Still File a Claim Now in 2026?

Most class action lawsuits come with a firm deadline. If you missed that original filing window, your claim may no longer be accepted. Courts set these cut-off dates to keep the process fair and organized for everyone involved.

However, in rare cases, the court may approve an extended filing period or allow a second phase for late claims. This usually depends on how many people filed on time, how much money remains, and whether any errors occurred in the notice process.

To find out your current options, visit the official Kraft Heinz Fair Fund website or the class action administrator page. These sites will clearly state whether claims are still being accepted or if the process has closed. Avoid relying on Reddit or other forums-only the official team can give you a correct answer.

If the deadline has already passed and the court has not reopened the process, you likely cannot join the case anymore. You also give up the right to file your own separate lawsuit on the same issue. That’s why it’s so important to act quickly and read every notice you receive.

Even if you missed this one, stay alert. Many investors only find out about class actions after it’s too late. Being proactive helps protect your rights in future cases

What the Lawsuit Means for Investors

This lawsuit carries serious weight. It proves that even the biggest brands must play fair and follow the rules. Investors rely on public reports to make decisions. When those reports are false, the damage can be real-and personal. People lose money, retirement savings, and trust in the system.

The Kraft Heinz case is a wake-up call, not just for shareholders but for other companies too. It shows that the SEC and courts will step in when a company misleads the public. No brand is too big to be held accountable.

For investors, this case is both a warning and a sign of hope. It shows that the law can protect you when companies break trust. Some investors will recover a portion of their losses. Others may not. But the process matters.

More importantly, the case may help raise the bar. It pushes companies to be more transparent with their numbers and more careful with what they tell the public. That’s a win for future investors-even beyond Kraft Heinz.

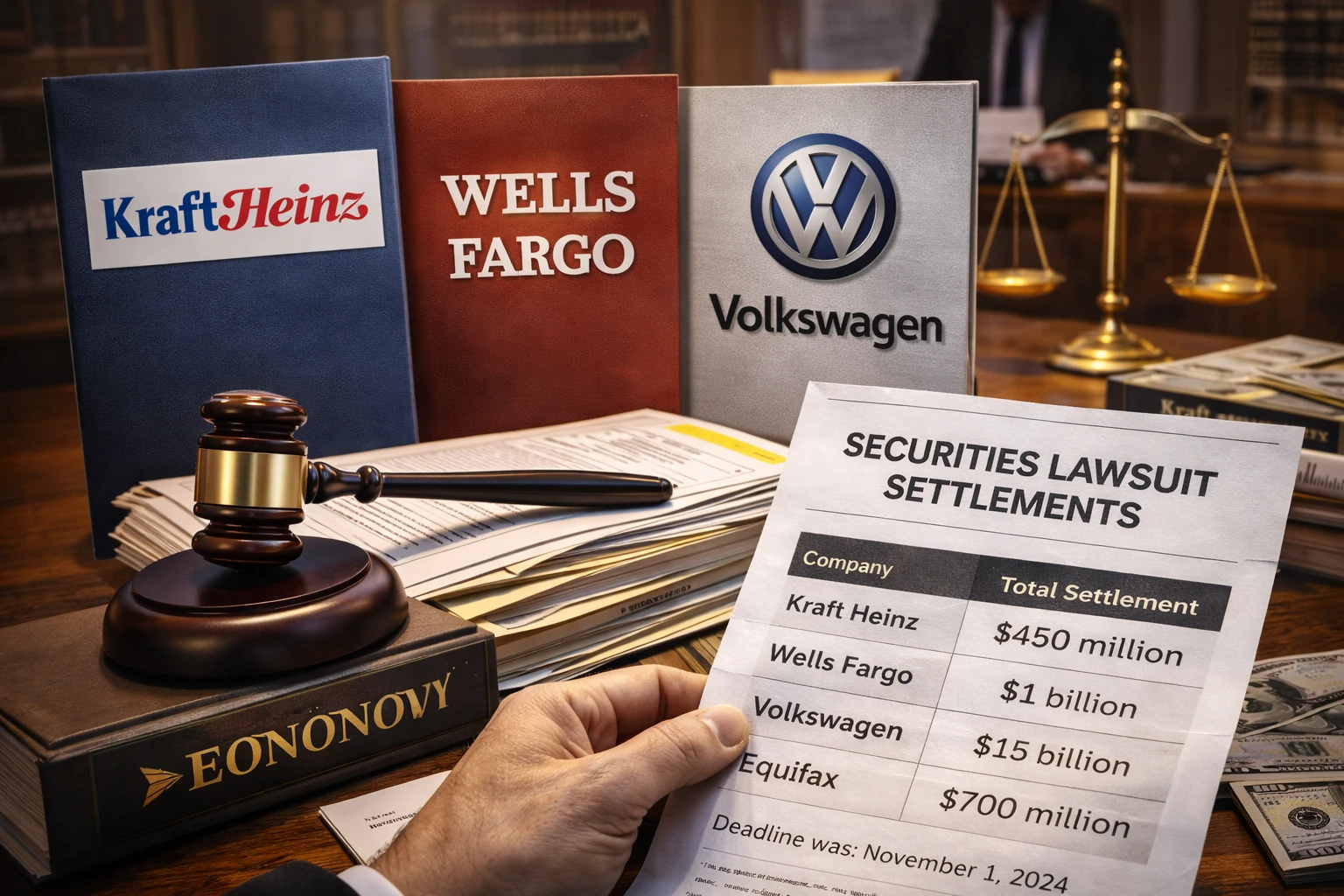

How the Kraft Heinz Case Compares to Other Big Lawsuits

The Kraft Heinz class action is one of the largest settlements in the food industry in recent memory. But it’s not the only major case where investors or consumers suffered big financial losses due to misleading information.

This lawsuit mirrors well-known cases like Wells Fargo, Volkswagen, and Equifax, where companies misled the public, and the truth led to a financial reckoning. Each of these cases involved broken trust, stock losses, and massive settlements. They also exposed how difficult it can be to uncover and prove corporate fraud.

In the Kraft Heinz case, like many others, the company did not admit wrongdoing, even after agreeing to settle. That’s typical in large securities lawsuits. Companies often settle to avoid drawn-out trials, rising legal fees, and more public damage.

Why the Fair Fund Matters

Most class action lawsuits offer only one path to payment-through the main settlement. But in the Kraft Heinz case, the Fair Fund created by the SEC added an extra layer of relief for investors.

The Fair Fund collected a $62 million penalty from Kraft Heinz and used it to repay harmed shareholders. This fund existed separately from the $450 million class action settlement, which is rare.

The extra fund increased trust in the process. It also put more pressure on Kraft Heinz by involving federal regulators in addition to the court system. Investors saw this as a sign that the misconduct was serious and deserved more than just a private settlement.

Together, these two outcomes-the lawsuit and the SEC Fair Fund-gave investors multiple chances to recover. It also set a stronger precedent for future corporate fraud cases.

Your Legal Rights in This Case

As a class member, you have several important rights. These rights protect your ability to participate fairly in the lawsuit and claim any money owed to you.

You have the right to:

Get clear notice of the case

The court ensures you receive proper updates through mail or email, so you understand the case and your options.File a claim for payment

If you qualify, you can submit your claim before the deadline to be considered for a payout.Object to the deal if you disagree

If you feel the settlement terms are unfair, you had the chance to tell the court during the review process.Opt out if you want to sue alone

Before the settlement was finalized, you could choose to leave the class and bring your own separate lawsuit.

If you do nothing, and you meet the eligibility terms, you are still part of the class. However, you may not receive any money unless you file a claim form. Always act before the deadline to protect your rights.

You also have the right to reach out directly to the claims team. You can email or call with questions. Do not pay a third party to file for you. The official process is free, secure, and designed for the public.

What If You Do Not Agree With the Settlement?

If you did not agree with the settlement terms, the court gave you a chance to speak up. During the fairness hearing, class members could file objections or request changes. Some investors did raise concerns about payout amounts and deadlines. But after reviewing all input, the court approved the final deal.

Now that the settlement is official and final, you cannot opt out or challenge it further. If you remain in the class, you must either accept the settlement terms or give up your right to receive payment. You also lose the option to sue Kraft Heinz separately over the same issue.

If you filed a timely objection, it became part of the public court record. Your opinion was considered before approval. If you did not object before the deadline, you are now bound by the terms as they stand. Going forward, you must follow the official payout process to claim your compensation.

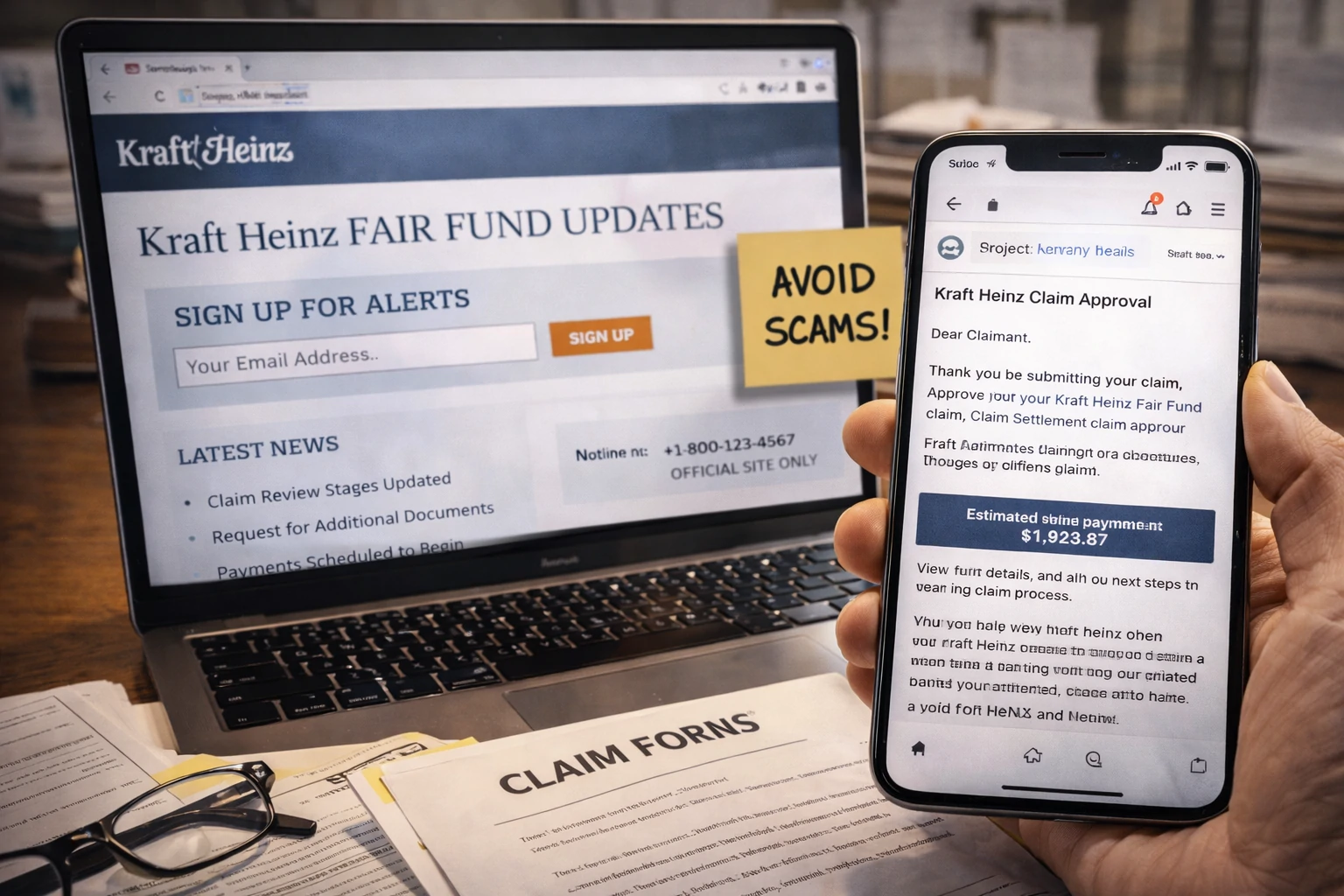

Need Help With Your Claim? Start Here

If you have questions about your claim or need support, always use trusted sources. Do not rely on random blogs, ads, or social media messages. Here are safe places to start:

www.kraftheinzfairfund.com – The official site for updates, forms, deadlines, and contact details

www.sec.gov – The U.S. Securities and Exchange Commission site with official case documents

Class action administrator pages – These are listed in your notice or confirmation email

Be careful online. Avoid any page that asks for your bank login, Social Security number, or payment to “speed up” your claim. Real class action sites never charge a fee.

You also do not need a lawyer to file a valid claim. Most people complete the process alone. All you need is your stock trade records, a filled-out form, and attention to deadlines. If you do want help, only use licensed professionals.

If you run a law office or help clients with consumer claims, you may want to explore how local attorney office signage in Hixson, TN helps improve walk-in trust and visibility.

How to Stay Updated on Future Payouts

Sign up for alerts on the Fair Fund website

The claims site often posts updates about review stages, deadlines, and payment batches. Email alerts help you stay ahead.Check your email inbox and spam folder

Sometimes, important messages go to junk or spam. Always review both folders so you don’t miss confirmation or correction requests.Add the claims team email to your safe sender list

This prevents messages from being blocked or filtered. It ensures timely delivery of payment notices or document requests.Watch the official site for new notices

Bookmark the Fair Fund page and visit it weekly. All official news will be posted there before it appears elsewhere.Avoid unofficial websites and scams

Do not trust random pages or emails asking for fees or passwords. Stick to “.gov” and the official class action pages listed in court documents.

What Claimants Actually See

Behind every lawsuit are real people with real financial struggles. Some investors lost retirement savings built over decades. Others kept holding Kraft Heinz stock, believing in the company’s strength-even through market dips and bad press.

The lawsuit gave many of these individuals a rare opportunity to fight back. It offered a chance to recover part of what they lost. For some, it meant relief during hard financial times. For others, it was about standing up for fairness in the market.

Thousands of people from across the U.S. and even overseas took part in the claim process. Their stories show that no investor is too small to matter. Legal action can give power back to regular shareholders when corporate trust is broken.

People from all over the U.S. – took part in the claim process. Many used only a few simple documents. Some were new to class actions. Others had joined cases before. Their experience shows that everyday investors can still fight back through the legal system.

Final Thoughts

The Kraft Heinz class action lawsuit is a strong example of how corporate decisions affect real people. Investors placed their trust in a brand known for its history and household products.

But when the company gave false financial numbers, that trust was broken. The lawsuit created a legal path for those investors to seek justice and reclaim part of their losses.

This case is not just about money. It’s also about accountability. Large companies must report the truth. When they fail, the law gives investors a voice.

If you bought Kraft Heinz shares during the class period and took a financial hit, you may still have options. Filing your claim could lead to a payout. It also supports transparency and fairness in the stock market. Taking action now helps protect your future-and strengthens trust for everyone.

Watch updates, meet deadlines, and share this guide with others. Legal action like this reminds everyone that honesty still matters.If your situation involves unsafe property or crime-related injury, consider speaking with a negligent security attorney to explore your legal options beyond investor claims.