Tax issues often frustrate people. Most follow the rules, pay what they owe, and expect fairness. But when taxes go up sharply or without clear reasons, doubts grow. Is it legal? Is it fair? Can taxpayers fight back? In recent years, many have tried. Some lawsuits won. Others did not.

In 2026, this debate is louder than ever. Across cities and states, lawsuits continue to rise. Some claim tax hikes were passed without clear votes. Others say new taxes target the middle class unfairly. Many feel blindsided by changes they never agreed to.

Homeowners worry about higher property tax bills. Small businesses face rising fees and new levies. Even renters feel the pain as landlords raise rent to cover extra costs. At the heart of all this is one question: do taxpayers have legal options when taxes rise too much or too fast?

This guide explains the facts, law, and your rights. It walks through past lawsuits, current updates, and what may come next. Whether you are a taxpayer, landlord, or business owner, this article helps you understand what the tax rise lawsuit means in 2026.

What Is a Tax Rise Lawsuit?

A tax rise lawsuit is a legal case where taxpayers challenge a tax increase. The goal is to prove that the tax hike was unfair, illegal, or passed without following the right steps. These lawsuits may involve income tax, property tax, sales tax, or business taxes. Most cases target how the tax was approved or which group it affects the most.

Some lawsuits focus on the process. Did lawmakers follow legal rules? Was the public given notice? Did voters get a chance to weigh in? Other lawsuits argue about fairness. Does the tax target one group unfairly? Does it place a heavy burden on people who cannot afford it?

In many cases, these lawsuits ask the court to block or cancel the tax. Some aim for refunds. Others push lawmakers to fix the law or change how taxes are passed in the future.

Who Files These Lawsuits and Why?

Tax rise lawsuits come from different people. Some are filed by homeowners. Others are filed by businesses, industry groups, or taxpayer rights groups. In some cases, lawyers file class action lawsuits on behalf of many affected people.

People file these lawsuits for many reasons. Some feel the tax was rushed without notice. Others claim it violates local or state law. Many believe the tax was hidden in unclear language. Some say lawmakers broke promises to voters.

At the core, most plaintiffs feel that the system failed them. They want to be heard They want change. They want to stop what they see as an abuse of power.

Recent History: Tax Rise Lawsuit Update 2021

The year 2021 saw a wave of tax rise lawsuits in several states. One major case came from California. A group of property owners challenged a local tax passed without voter approval. They claimed the city violated Proposition 13 rules, which limit tax increases without a vote.

In Illinois, a business group sued the state over a new tax on digital services. They argued that it was too vague and unfairly targeted small firms.

Another case in Texas saw landowners push back against property tax hikes. They claimed the appraisals were inflated and not based on real market value.

Most of these lawsuits raised attention. Some were dismissed. Others moved forward. A few ended in settlements or changes to the tax rules.

What Happened in 2022? Tax Rise Lawsuit 2022 Recap

In 2022, more lawsuits followed. In New York, small business owners filed a lawsuit against new business taxes that came without a full legislative vote. They argued that the tax created a double burden during economic recovery.

Arizona saw a lawsuit over a transportation tax increase. Residents claimed the ballot language was misleading. They said voters were not given a clear view of what they approved.

In Oregon, property tax hikes faced legal review. Residents said they were not given enough time to protest the changes. Some challenged the data used for tax assessments.

These cases show one thing: tax issues are not just about money. They are about trust, process, and fairness.

Tax Rise Lawsuit Update 2026

As of 2026, lawsuits are still active in many parts of the country. Several class action cases are under review. One major lawsuit in Florida challenges a new local tax used to fund private developments. Critics say it benefits wealthy builders more than the public.

In Michigan, a group of seniors sued over property tax changes that raised bills on fixed-income households. Their case argues that the tax violates equal protection laws.

A new lawsuit in Nevada claims that hidden service fees added by local governments are actually illegal taxes. The plaintiffs argue that calling them “fees” is misleading and avoids voter oversight.

These updates show that the fight is not over. Courts are still hearing cases. Outcomes vary by state. But the trend is clear. More taxpayers are pushing back.

What Taxpayers Are Saying: Tax Rise Reviews and Complaints

Online forums and review sites have seen more posts about tax issues. On Reddit, people share stories of surprise tax bills and sudden hikes. Some say they were never told about new assessments. Others say their income stayed the same, but their taxes rose anyway.

Many complaints focus on lack of notice. People say cities changed rates without warning. Some claim their bills doubled in two years. Others say they asked for help and got no clear answers.

Business owners are also speaking out. Some reviews warn that taxes are hurting profits. Others share tips on how to appeal assessments or join lawsuits.

The common thread is frustration. People feel unheard and overcharged. They want change. And they are using lawsuits and public pressure to get it.

Tax Rise Lawsuit Update Reddit

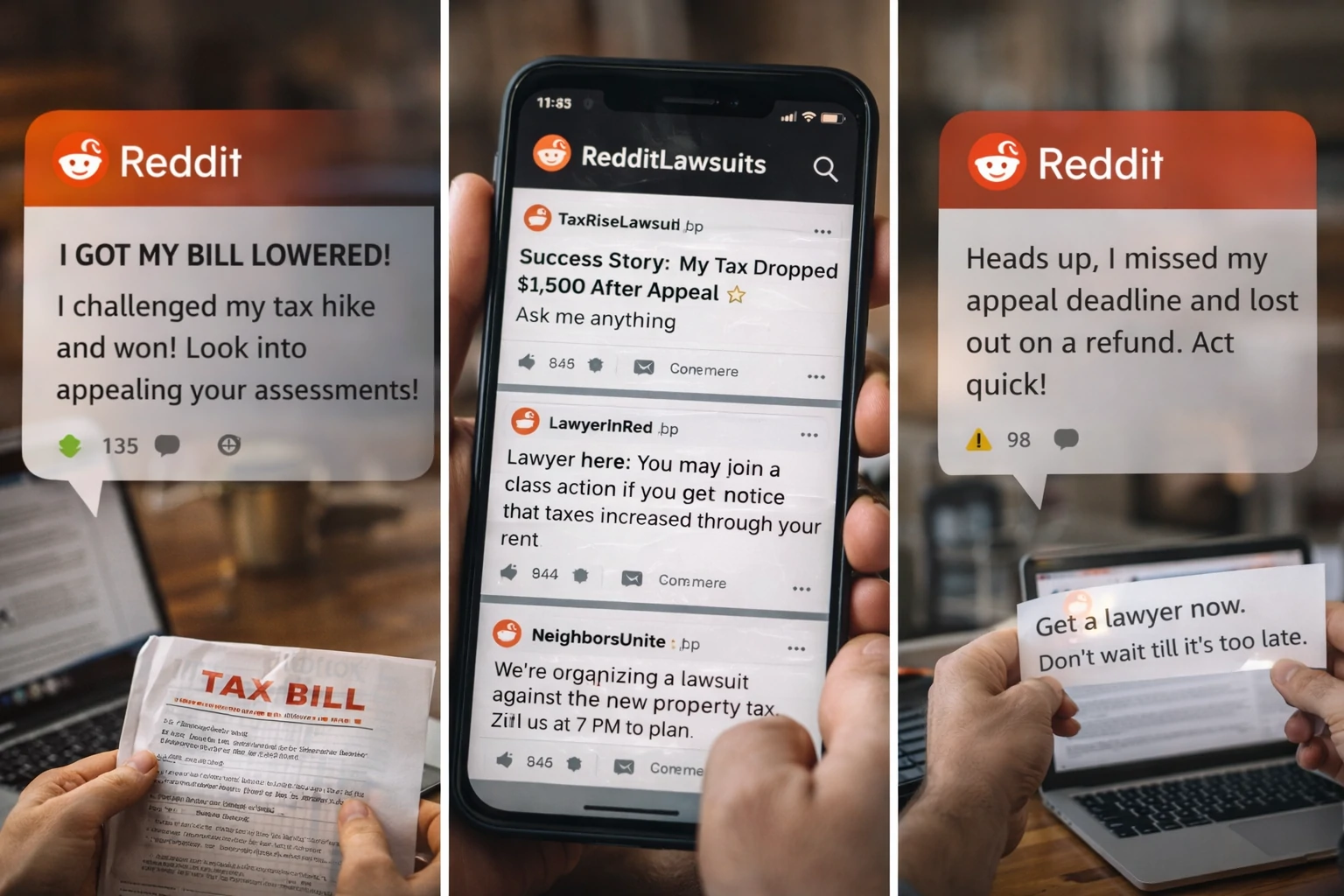

Reddit has become a major place for tax rise lawsuit updates. Users post court documents, lawyer links, and news stories. Threads often discuss how to file appeals or join a legal group.

Some Reddit users report success. One said their local tax increase was rolled back after a group lawsuit. Another claimed they got a refund after proving their home was over-assessed.

But not all stories end well. Some posts warn that lawsuits can take years. Others say courts often side with local governments. A few share tips on using media or public outreach to support the legal fight.

Reddit helps people connect, share facts, and get advice. It is not a legal site, but it shows how active and engaged taxpayers have become.

Some users also mention local law firms that helped them fight unfair taxes, such as the Kania Law Firm, known for honest legal help.

What Reddit Users Say About Tax Rise Lawsuits

Reddit posts offer insight into how people feel. Many users share frustration, fear, and action steps.

Personal Stories

Some users post about winning appeals. One user said their tax bill dropped after a successful challenge. Others share how they got lawyers involved or helped organize neighbors.

Warnings and Red Flags

Reddit threads also warn people. One user explained how late filing ruined their refund chance. Another said their tax consultant missed key appeal deadlines. These stories push others to act early and stay informed.

Legal Advice Shared on Reddit

Some threads link to free legal help. A few lawyers give tips or explain legal steps in plain terms. These posts help users who cannot afford legal fees.

Can You Sue Over a Tax Increase?

Many people do take legal action when tax hikes feel unfair. But your ability to sue depends on the law in your state or city. Some places require you to file a formal claim first. Others may need you to join a group lawsuit. Legal challenges often focus on how the tax was passed or who it harms the most.

To file a lawsuit, you must show legal harm. This means proving the tax was passed unfairly, broke local rules, or skipped required steps. Most cases need help from a lawyer. Timing matters too. Many tax laws set short deadlines to file a legal challenge.

Not every case leads to a win. Still, lawsuits have blocked or changed taxes in the past. If the system failed you, legal action can be a valid and powerful step.

📌 Real Case Study: John D. from Texas

In 2022, John noticed a 42% jump in his property tax. He filed an appeal with his county using market data. The board ruled in his favor. His bill dropped by $1,400. “It was worth the effort. I just followed the public guide,” he says.

How to Join or Start a Tax Rise Lawsuit

If you want to join a lawsuit, look for local legal groups or class action lawyers. Some firms focus on tax issues. Others handle property or business law. Ask if they offer free reviews.

You can also file a case alone, but this is hard without legal help. Courts expect clear filings and strong evidence. Most people need a lawyer to guide them.

Class action suits allow many people to sue as a group. This lowers costs and adds weight. If a lawyer takes the case, they may collect payment only if they win.

Check with your city or county to learn how the tax was passed. Get documents, notices, or meeting notes. These may help your case.

| Year | State | Case Summary |

|---|---|---|

| 2021 | California | Property owners sued over tax passed without voter approval (Prop 13 violation) |

| 2022 | Illinois | Businesses filed lawsuit over vague digital service tax |

| 2022 | Arizona | Lawsuit over misleading ballot language for transportation tax |

| 2023 | New York | Class action filed against landlord-related tax hikes |

| 2026 | Florida | Lawsuit targets tax used to benefit private developers without public vote |

| 2026 | Michigan | Seniors sued over property tax increases impacting fixed-income households |

| 2026 | Nevada | Lawsuit claims hidden service fees are illegal taxes requiring voter input |

Questions to Ask Before Taking Legal Action

Legal steps can take months or even years. You must prepare before making that choice. Ask yourself these key questions to stay on the right path.

Was the Tax Applied to You?

You must be directly affected to file a case. This means your name or business must appear on the tax bill. Gather all records that show the tax was charged to you.

Did You Get a Chance to Vote or Comment?

Some taxes require public notice or a vote. If your city or county skipped that step, your rights may have been ignored. Check official notices, council records, or mailed alerts.

Can You Find Others Affected?

Courts listen more when many people speak. Ask neighbors, business groups, or online forums to see if others face the same tax issue. Group claims have stronger legal power.

Do You Have Legal or Financial Support?

Tax cases need time, proof, and expert help. Find a lawyer who handles tax or class action claims. If you can’t afford one, ask local legal aid or nonprofit groups for free help.

What to Do If You Can’t Afford a Lawyer

Some legal aid groups help with tax issues. Look for nonprofit law centers in your state. They may help you understand your rights or file paperwork.

You can also contact your elected officials. Some cases are solved outside court when enough people speak up. Media pressure also works in some areas. Sharing your story may help change the rules.

If your issue is with property taxes, many counties have appeal boards. You can ask for a review without going to court. This works best when you have proof your bill is wrong.

How the Law Looks at Tax Increases and Your Rights

Most states allow lawmakers to raise taxes. But they must follow clear rules. Some places require a vote. Others need public notice. Some laws cap how much taxes can rise in a year.

If officials skip steps or hide the full cost, courts may step in. Judges often look at fairness, public notice, and process. They ask: was the tax fair? Was it legal? Were voters informed?

If a tax fails these tests, courts may strike it down or order changes. But not all taxes break the law. Even unfair taxes may stand if passed correctly.

What States Are Most Affected by Tax Rise Lawsuits in 2026

Some states have seen more legal action than others. This usually happens where taxes rose fast or without much warning.

California

Many lawsuits in California deal with property tax changes. Some claim the state allowed too many increases through ballot tricks. Others say local governments skipped proper notice rules.

Florida

In Florida, lawsuits focus on hidden fees and taxes that help developers. People argue these charges were added without a vote. Some say they benefit a few while hurting the rest.

New York

New York faces lawsuits over business taxes and rent-related fees. Some landlords claim new taxes were passed unfairly. Others say changes pushed renters into higher costs.

Illinois and Texas

Both states saw lawsuits after large property tax hikes. Owners argue that cities inflated home values on purpose. Some claim this was done to raise revenue quickly without a vote.

Tax Rise Company Reviews and Public Trust

Some private companies help local governments collect taxes or manage fees. In recent years, several of these companies have drawn criticism. Reviews mention poor service, unclear bills, and hidden charges.

On sites like Trustpilot and Reddit, users complain about surprise fees or collection threats. Some say the company miscalculated what they owe. Others say they never got notice before legal action started.

These reviews matter. Public trust falls when people feel tricked. If a company handles your taxes, look into its reputation. Bad reviews may show a pattern of problems. Some lawsuits name these companies too.

Some lawsuits name these companies too – similar to how major retailers like Home Depot faced lawsuits over false advertising.

How to Check If a Tax Is Legal in Your Area

You do not need to be a lawyer to ask smart questions. Basic research can help you see if the tax followed the law. Use public records and local sources to get answers fast.

Look at City and County Meeting Records

New taxes often begin in local meetings. These records list who voted, what was said, and why the tax passed. Check your city or county website for full access to meeting notes.

Review Official Notices and Mail

Tax rules often require clear notice to the public. Look through letters, flyers, or posted signs you may have received. If nothing came before the change, that may be a legal concern.

Ask the Tax Office to Explain the Change

Contact your local tax or finance office. Ask them to explain the increase in plain terms. You can also ask for the rule, date of approval, and who voted for it.

Search Your State Constitution

Each state has rules on how taxes can change. Some limit yearly increases or require public votes. Visit your state’s legal website and look for tax-related sections to learn more.

What Rising Tax Lawsuits Could Mean for You in the Future

The number of tax rise lawsuits is growing. Courts are split. Some support taxpayers. Others back local powers. But more people are paying attention.

In 2026, voters, lawmakers, and courts will face pressure to change how taxes are raised. Some may call for stricter laws. Others may demand clearer notice and limits. The public voice is louder now.

This movement may reshape tax law in the years ahead. Lawsuits often drive reform. They shine light on bad practices. They force leaders to explain their choices.

What Courts Usually Look for in Tax Cases

Judges follow the law, but they also care about how the tax was created. They check if officials followed fair steps. Clear process and equal treatment matter in these cases.

Did Lawmakers Follow Rules?

Courts review how the tax was passed and announced. They check if the vote or approval followed legal rules. Judges also ask if the public had clear notice before the tax took effect.

Was the Tax Discriminatory?

If the tax hits one group harder than others, the court may take issue. Seniors, renters, or small firms may claim unfair impact. Equal treatment under the law is a key point in such cases.

Was There Fraud or Misuse of Power?

Some lawsuits claim that leaders abused tax power. If a tax funds private gain or skips public review, courts may act. Judges look for signs of corruption or hidden motives behind the law.

Conclusion

Taxes affect every part of life. From rent to food to business, rising taxes hit hard. When they feel sudden or unfair, people speak up. In 2026, the tax rise lawsuit trend shows no signs of slowing.

You don’t need to stay silent. Know your rights. Ask questions. Join others who want fairness. If your bill feels wrong, explore legal help. Share your story. Help shape what comes next.

Whether you win or lose, standing up matters. The tax system must serve the people. Lawsuits help test that promise. Stay alert, stay informed, and stay strong.