Each spring, Canadians across the country sit down to file their taxes. Most follow the steps, enter numbers, and submit their returns without much thought. But one line matters more than most. That line is 15000.

This number tells the Canada Revenue Agency (CRA) how much money you earned before anything is taken off. It used to be Line 150. The government changed the numbering system in 2019. The meaning stayed the same. Line 15000 shows your total income from all sources.

You do not subtract deductions here. This number does not show how much tax you owe. It is not your refund. Still, it affects both. It sets the stage for the rest of your return. The CRA uses this number to calculate benefits, review eligibility, and check for errors.

Many people overlook Line 15000. That mistake can cost you money. If the number is too low or too high, it may delay your return. It may block your benefits or lead to a CRA review. This guide will walk you through the full meaning of Line 15000. It will show what goes into it, how it affects your tax return, and why it matters in real life.

What Is Line 15000 on a Tax Return?

Line 15000 shows your total income for the year. This is also called your gross income. It includes all money you earned from every taxable source. You report this number before claiming deductions like RRSP contributions, childcare costs, or union dues.

The CRA uses this line to start your tax calculation. This number feeds into your net income and taxable income. It also plays a role in your eligibility for support programs, like the Canada Child Benefit or student aid.

If your Line 15000 goes up, your taxes may go up. If it goes down, you may qualify for more credits or benefits. But this number is just the base. What you earn is not always what you keep. That is why the government subtracts deductions and credits later in the return.

What Income Does Line 15000 Include?

Line 15000 includes all sources of taxable income. If you received money in Canada and the CRA considers it taxable, it likely appears here.

Job Income (T4 Slips)

Your T4 slip shows wages, salary, bonuses, vacation pay, and other job earnings. The amount in Box 14 of each T4 adds into Line 15000. If you worked for more than one employer, include all slips.

Self-Employment Income

Freelancers, contractors, and business owners report income on Form T2125. The gross business income from this form adds to Line 15000. This does not subtract expenses. That comes later.

Pension and Retirement Income

This includes money from:

- Canada Pension Plan (CPP)

- Old Age Security (OAS)

- Employer pensions

- RRIF withdrawals

- Annuities

You receive these amounts on T4A, T4A(P), and T4A(OAS) slips.

Government Benefits (Taxable)

Some benefits count as taxable income. These include:

Employment Insurance (EI)

Social assistance (in some cases)

Workers’ compensation

COVID-19 emergency benefits (CERB, CRB, etc.)

Each comes with a slip. Most appear on a T4E.

Investment Income

Line 15000 includes:

Interest from bank accounts, bonds, and GICs

Dividends from stocks or mutual funds

Capital gains (50% of gains count as taxable)

You’ll get T5 and T3 slips to report these.

Rental and Royalty Income

If you rent out property or receive royalties, that money also adds to your total income. You report it using rental forms or T5 slips.

Other Taxable Sources

These include:

- Tips and gratuities (if reported)

- Scholarships and bursaries (some taxable)

- Death benefits

- Support payments received (if taxable)

If you’re unsure, check CRA’s full list or speak with a tax expert.

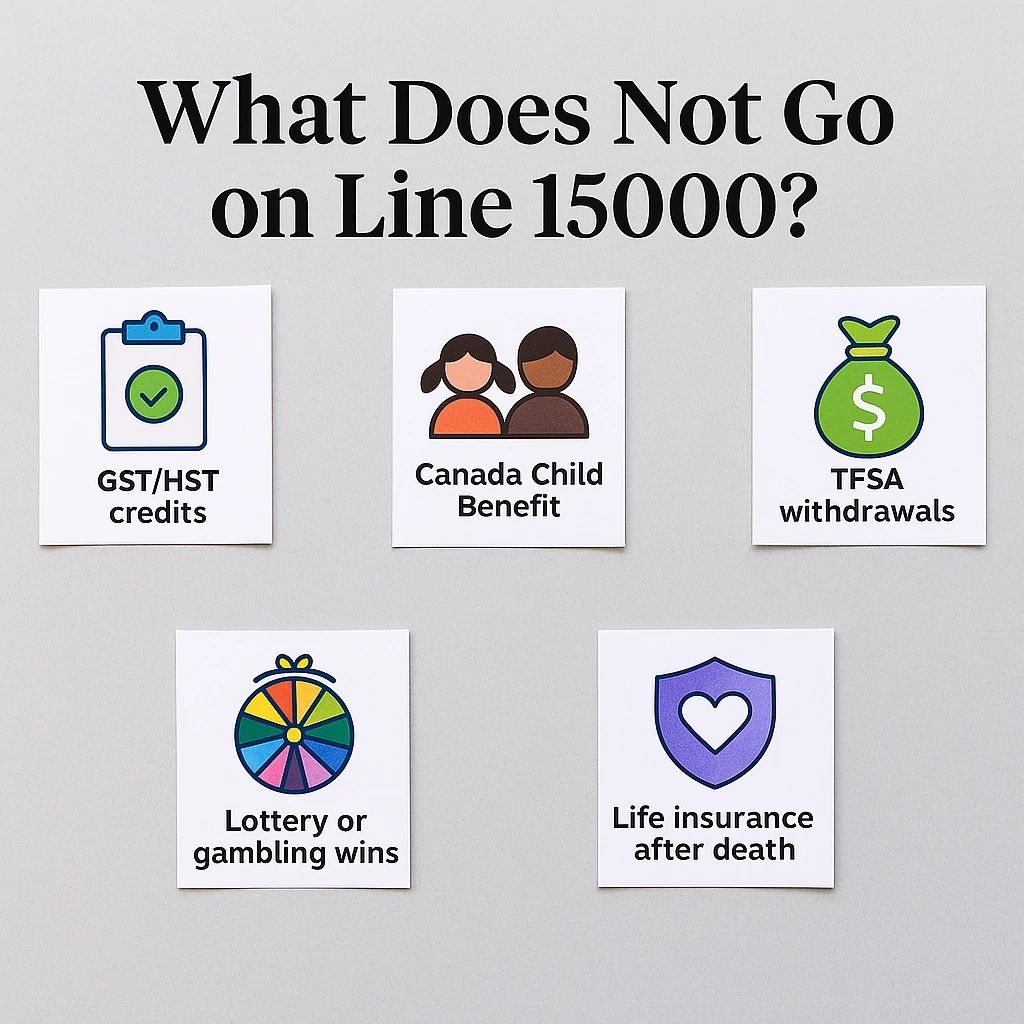

What Does Not Go on Line 15000?

Not all income is taxable. Some amounts are tax-free and do not appear on Line 15000.

Examples include:

- GST/HST credits

- Canada Child Benefit (CCB)

- TFSA withdrawals

- Lottery or gambling wins

- Gifts and inheritances

- Life insurance after death

These do not affect your return. You should not include them. If you do, it may inflate your income and reduce your benefits.

Line 15000 and Newcomers to Canada

Newcomers report Line 15000 in a different way during their first year. Many do not earn income in Canada before they arrive. CRA only asks for income you earned after your arrival date. This rule applies to employment income, investment income, and any other taxable sources inside Canada.

If you earned money outside Canada before you moved, CRA does not place that amount in Line 15000. You may still report world income on a separate form, but it does not enter your Canadian total income line.

Some benefits depend on your world income. CRA may ask for proof of foreign earnings to check your eligibility. If you cannot provide full documents, CRA may delay your benefits. Keep all records from your home country to avoid problems.

Newcomers often qualify for benefits like GST/HST credits or provincial support. CRA uses your first Line 15000 as part of this review. That is why accurate reporting is important in your first tax year.

eed legal help with driving‑offence matters? See this guide: Hoover DUI Attorney – What You Should Know.

Where Can You Find Line 15000?

You can find this number in three places:

1. Your T1 Tax Return

Line 15000 appears under the “Total Income” section near the top of your return. It’s one of the first numbers that matter.

2. Your CRA Notice of Assessment

After filing, you get a Notice of Assessment. It includes Line 15000 in the income summary. Lenders and benefit programs often ask for this document.

3. CRA My Account

If you use the CRA’s online portal, log in and view past returns. Your Line 15000 number will show up under tax return details.

Tools That Help You Track Line 15000

You can track your Line 15000 with simple tools. These tools help you stay ahead of tax season and avoid common mistakes.

CRA My Account

This is the most direct place to check your tax slips. CRA collects slips from employers, banks, and pension plans. You can see all slips in one place and confirm your total income.

Certified Tax Software

Many programs auto-fill your slips. These tools reduce mistakes and place the right values directly into your return. They also update your Line 15000 as you enter new slips.

Slip Download Tools

Some banks and payroll systems offer slip downloads early in tax season. This helps you track income before CRA updates your file.

Personal Income Trackers

Simple spreadsheets or budgeting apps help you list your income through the year. This gives you a clear picture of what will enter Line 15000.

If you use these tools together, your return stays clean and accurate. Your Line 15000 will match your proof and help you avoid CRA delays.

Want a look at business advice and growth tools too? Check this guide: Pedrovazpaulo Operations Consulting – Smart Solutions to Help Your Business Grow.

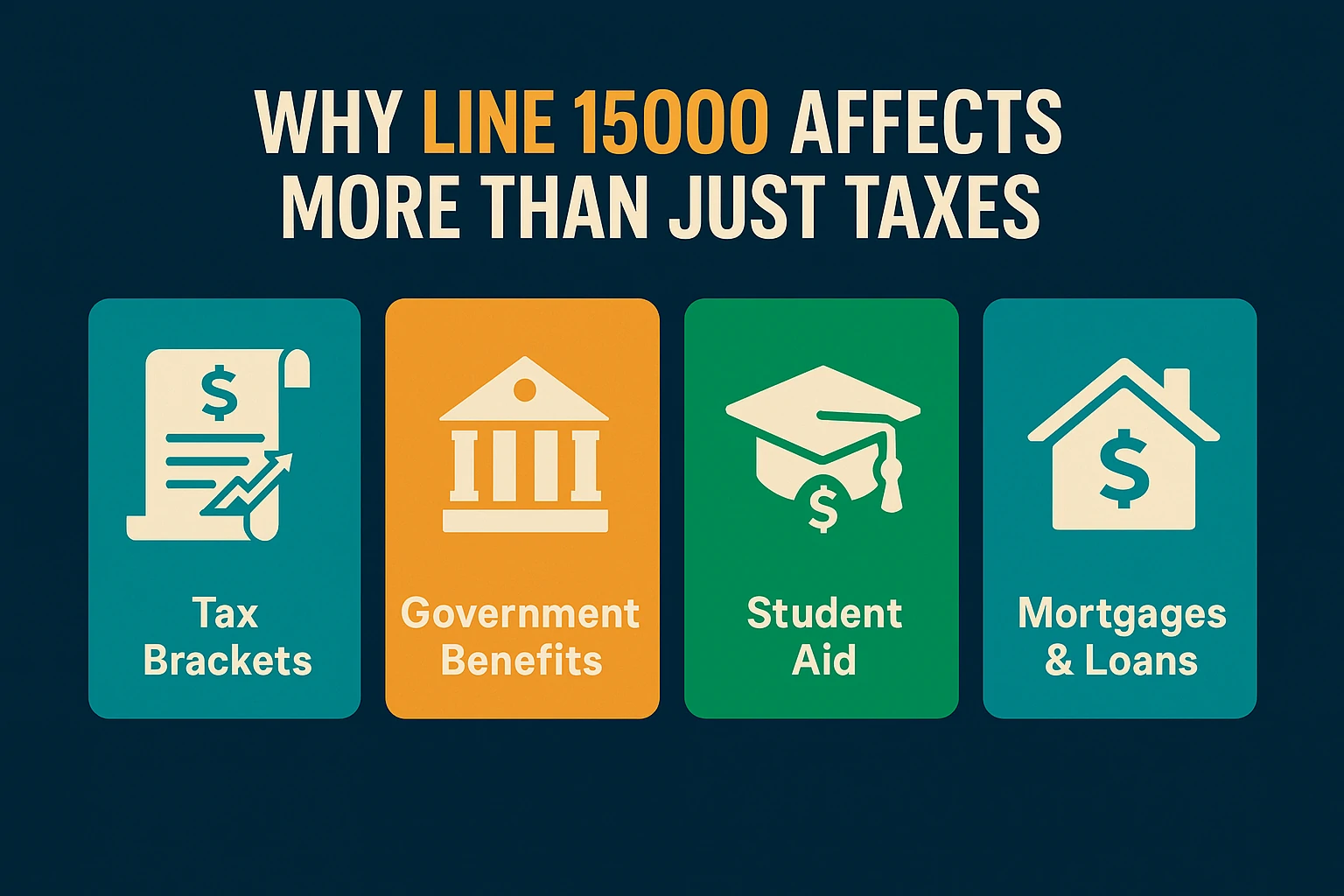

Why Line 15000 Affects More Than Just Taxes

Line 15000 is more than just a starting point for taxes. It plays a direct role in many areas of your financial life. This number shows how much income you had before deductions. That single figure affects your taxes, your government benefits, and even your chances of getting a loan.

If your Line 15000 is higher, you might move into a new tax bracket. You might lose access to some support programs. You might also qualify for bigger loans based on your income. If the number is lower, the opposite may happen. That is why this line deserves careful attention.

Tax Brackets

The tax system in Canada uses brackets. These brackets decide how much tax you pay. Line 15000 helps place you in a federal or provincial bracket. It does not set your final tax bill, but it starts the process.

Higher income means a higher bracket. That could increase your total tax bill. Even a small change in Line 15000 might move you into a new range. That is why the CRA takes this line so seriously.

If you report more than you earned, you could pay too much tax. If you report less than you earned, the CRA may reassess your return. Both cases create stress. That’s why your Line 15000 must match your income slips.

Government Benefits

Many benefits use this number to check if you qualify. These include both federal and provincial programs. If your total income goes up, your benefit amounts may go down. Some programs may stop completely if your income crosses the limit.

Programs like these use Line 15000:

- Canada Child Benefit (CCB)

- GST/HST Credit

- Old Age Security (OAS)

- Guaranteed Income Supplement (GIS)

- Ontario Trillium Benefit

- Alberta Child and Family Benefit

The higher your Line 15000, the less support you may get. In some cases, a $1 increase could reduce your monthly credit.

Student Aid

Many student loans and grant programs ask about your parents’ income. When a student applies, the system checks Line 15000 from the parent’s return.

If both parents report high incomes, the student may not get a full grant. If incomes are lower, the student may receive more money. Some provinces use Line 15000 to decide eligibility for textbooks, housing grants, or transportation help.

That is why parents need to report Line 15000 correctly. A mistake could block their child from important financial aid.

Mortgages and Loans

Banks use this number to check your gross income. If you apply for a car loan, credit card, or mortgage, they may ask for your Notice of Assessment. Line 15000 shows how much money you earned before deductions.

What Happens If Line 15000 Is Wrong?

If you enter the wrong number, you may face problems:

- CRA might reassess your return

- Your refund could be delayed

- You could lose benefits

- You might face interest or penalties

Mistakes happen when:

- You forget a slip

- You double report the same income

- You enter the wrong box from a T-slip

- You include non-taxable money

Always match your return with the slips you receive. Log into CRA My Account to double-check what they already have.

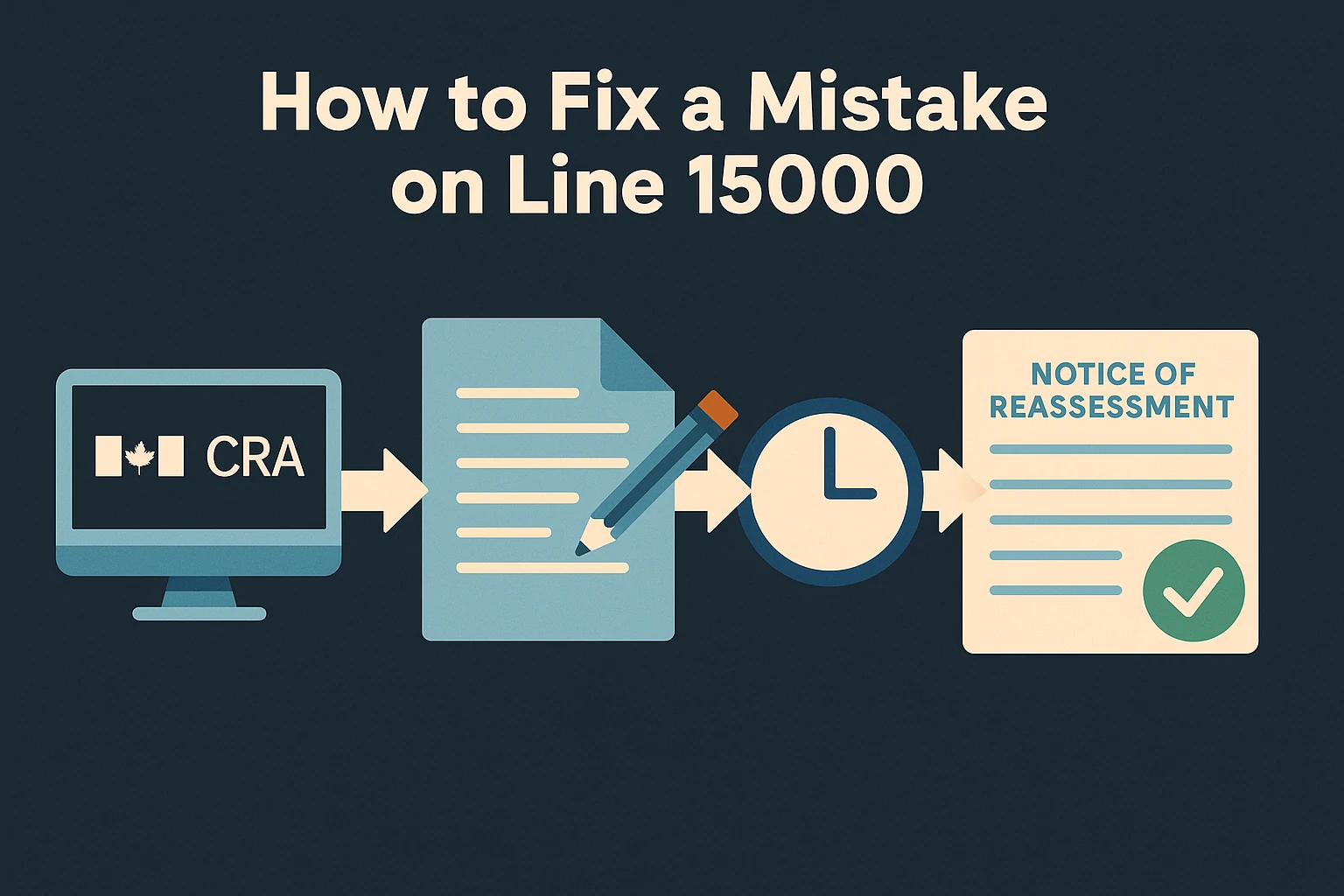

How to Fix a Mistake on Line 15000

If you discover that your Line 15000 is wrong after filing, you can still correct it. Fixing the number ensures your return stays accurate. It also protects you from delays, audits, or benefit cuts.

Use CRA My Account

Go to the CRA website and log in to your personal My Account. Choose the option called “Change My Return.” Pick the year you want to fix. You can now update Line 15000. Type in the correct total income. Save the changes and submit.

This is the fastest way to correct your return. The CRA updates most online changes within two weeks. Keep copies of your corrected slips in case they ask for proof.

File a T1 Adjustment Request

If you prefer paper forms, use the T1-ADJ form. This is the official form to adjust a filed return. Write the year, the line number (15000), and the corrected amount. Include a short reason for the change. Attach updated slips or documents.

Mail the completed form to the CRA tax centre that handles your region. The address appears on the form instructions. Paper changes take longer, but they still fix your return.

What Happens Next

After you submit your correction, the CRA will review your request. If they agree with the change, they will issue a new Notice of Reassessment. This document replaces the old one. It shows your corrected Line 15000 and your new tax results.

Always double-check every number before filing. If your Line 15000 is right, the rest of your return becomes easier to manage.

Real-Life Examples

1: Child Benefit Impact

Sarah earned $42,000 last year. She forgot to include one T4 from a side job. CRA later added it, and her income went to $49,000. Her child benefit dropped by $110 per month. That small mistake cost her over $1,300 a year.

2: Student Loan Application

Daniel applied for a student loan. His parents made $85,000 combined. They included tax-free child benefits by mistake. Their Line 15000 appeared higher. As a result, Daniel qualified for only a partial grant.

3: Mortgage Application

Maria applied for a mortgage. The lender asked for two years of tax returns. They checked her Line 15000 to confirm steady income. That helped her secure the loan with better rates.

Line 15000 vs Net Income vs Taxable Income

These three lines often confuse people. Each one means something different. Here’s a simple table to help you understand how they work:

| Line Number | Name | What It Shows | Why It Matters |

|---|---|---|---|

| 15000 | Total Income | All taxable income before any deductions | Used to check eligibility for benefits and aid |

| 23600 | Net Income | Total income minus deductions like RRSP or union dues | Used to calculate credits and benefit clawbacks |

| 26000 | Taxable Income | The part of your income that gets taxed | CRA uses this line to calculate your tax owed |

Tip: If Line 15000 is wrong, the other two lines will also be wrong. Always check every slip before you file.

Tips to Keep Your Line 15000 Accurate

- Keep all T-slips

- Use CRA My Account to verify

- Do not guess numbers

- Report all income, even if it’s small

- Do not add child benefits or GST credits

- Use certified tax software

If you stay organized, your return will be easier, faster, and more accurate.

You can also compare Power of Attorney vs Conservatorship to understand which one may apply when lenders ask for legal documents.

Conclusion: Know Your Line 15000

Line 15000 shows more than just your earnings. It helps shape your full tax return. It affects your refund, your benefits, and your future plans.

This line holds power. It opens or closes doors to credits, loans, and support. You must take it seriously. One mistake can cost you money or delay your refund.

Always check your slips. Review your income. Match your numbers with CRA records. If anything looks wrong, fix it fast. A strong Line 15000 builds a strong return.

Understanding this line puts you in control. You pay what you owe, get what you deserve, and stay on the CRA’s good side.

Common Questions About Line 15000

Many people ask simple questions about Line 15000. These answers help you avoid mistakes and understand your return with more confidence.

Q. What slips add to Line 15000?

Slips that show taxable income add to this line. These include T4 for jobs, T4A for pensions, T5 for interest, and T3 for trust income. Each slip reports money the CRA counts as income.

Q. Can Line 15000 affect CERB repayment?

It can. CERB has income limits. If your Line 15000 shows more than the allowed amount in past years, CRA may ask for some money back.

Q. Is Line 15000 the same as total earnings?

It is not. Total earnings often mean wages from work. Line 15000 adds that plus pensions, rental income, dividends, and self-employment amounts.

Q. Do CRA errors affect my Line 15000?

They do. If a slip is missing or filed wrong, CRA may use the wrong amount. This can delay refunds or change your benefits. Always check your slips in CRA My Account.